SmartInsure : Online Solution for General Insurance

Insurance is a fast growing and highly competitive industry across the world. This industry is characterized by a large number of agents serving a diverse and geographically spread client base with a huge product portfolio. This necessitates an easy delivery channel for dissipation of information to agents. Equally important is an efficient system for accurate calculation of agent commissions. The process of calculation of commissions is inherently complex due to the large number of agents, products, clients, multiple payment headings and lines of business, and the very dynamic nature of the insurance business.

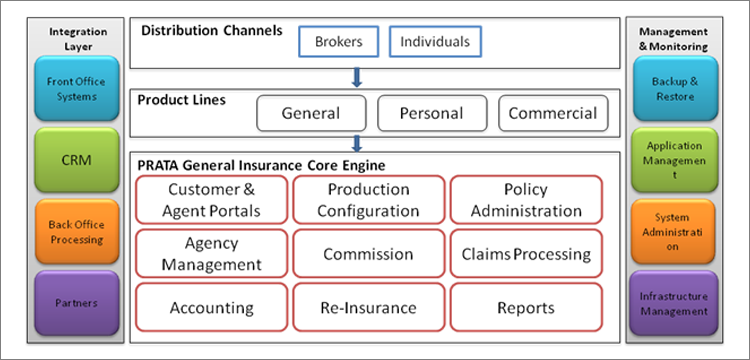

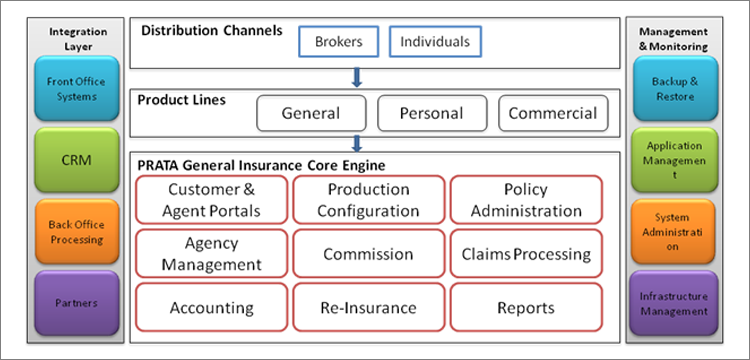

SmartInsure is Prata IT Solutions’ comprehensive software package solution designed to address these concerns. With modern technology, SmartInsure fully addresses the specific needs of General Insurance in terms of Speed, Transparency and accuracy and can calculate commissions automatically and quickly, under peak loads.

SmartInsure integrates with legacy systems for fetching commission data and allows dynamic and configurable setup of commission formulae. Solution equipped with tools and capabilities that are needed by carriers to quickly respond to changing business needs.

Major 3 modules of SmartInsure are:

A. Policy Administration:

- . Quote, Rate and Issuance

- . Policy Contract Administration

- . Mid term Endorsements

- . Manual and automated Renewal process

- . Contract Cancellation/Termination

B. Claims Management:

- . Direct and Agency and Account billing and collections for personal, commercial and specialty insurance products

- . Premiums, services, taxes and fees breakdown to coverage, risk and policy levels

- . Dynamic installment collection fees by payment plan

- . Flexible AP/RP endorsement premium spreading

- . Short / over payment management

- . Write off / threshold processing

- . Comprehensive payment methods with rejection management (CC, DD, EFT, Lock Box, Check, ACH)

C. Billing and Collection:

- Direct and Agency Billing - Support for all billing plans and types: direct, agent, account, group, list, 3rd party in a variety of installments and means

- Account Management - Account centric views for agents and customers reelecting their entire portfolio activity and debt with the ability to drill down to required detail for all billing activities

- Payment Plans - Custom installment plans, as well as the ability to change payment arrangements as required

- Premium, Commissions, Claims Payment - Track all billing items at the detail level to accurately manage premiums, commissions, taxes, discounts, surcharges, fees as well as claim payments for all interested parties down to the coverage level

- Receipt Processing - Manual and automated individual and batch cash and EFT receipt processing with automated allocation and suspense / unallocated management

- Receivable Management - Income control and alerts for delinquent payers.

Key Solution Features:

- Multiple lines of business packaged in one policy

- Multiple insured objects and assets

- Comprehensive data validation

- Premium calculations

- Differential rating based on multiple parameters

- Clause and form management

- Comparative quoting – multiple proposals for a single client

- Interactive, online payment schedule

- Automatic issuance of documents

- Online policy approval for immediate coverage

- Automatic and Manual underwriting and pricing

- Fully integrated with CRM

- Flexible workflow

Key Benefits:

- Flexible Integration

- Standard and open XML and Web-Services gateways

- Rating Engine

- In built Rating Engine with dynamically defined rate table structures and rating algorithms.

- Customized Dashboard

- Customer / Producer / Agent centric dashboard

- Flexible Workflow

- These processes may include specific workflows for every damage code, referral to third parties, follow-up letters, recurring payment validation procedures etc.

- Data is fully secure within the system

- Agents

- Policy Holders

- Claims